昨天我们说了微观部分的计算题:AS经济选择 | 微观计算题合集今天我们来看宏观部分。

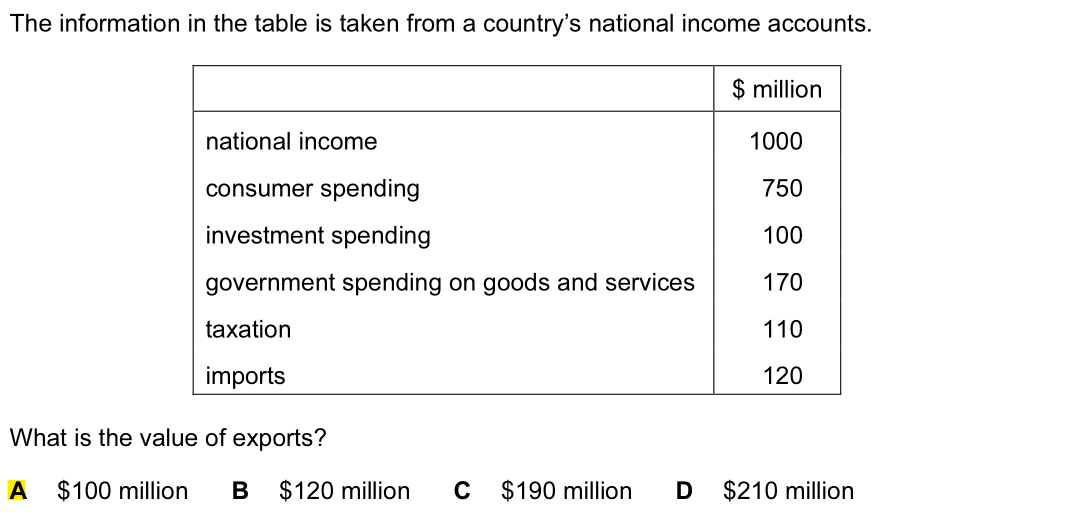

1. National incomea. Gross Domestic ProductExpenditure method: GDP = C + I + G + X - M. 750 + 100 + 170 + X - 120 = 1000X = $100 millionIncome method: GDP = rent + wage + interest + profit用income method算时候要注意unemployment benefit和pensions没有output,因此不能计入。

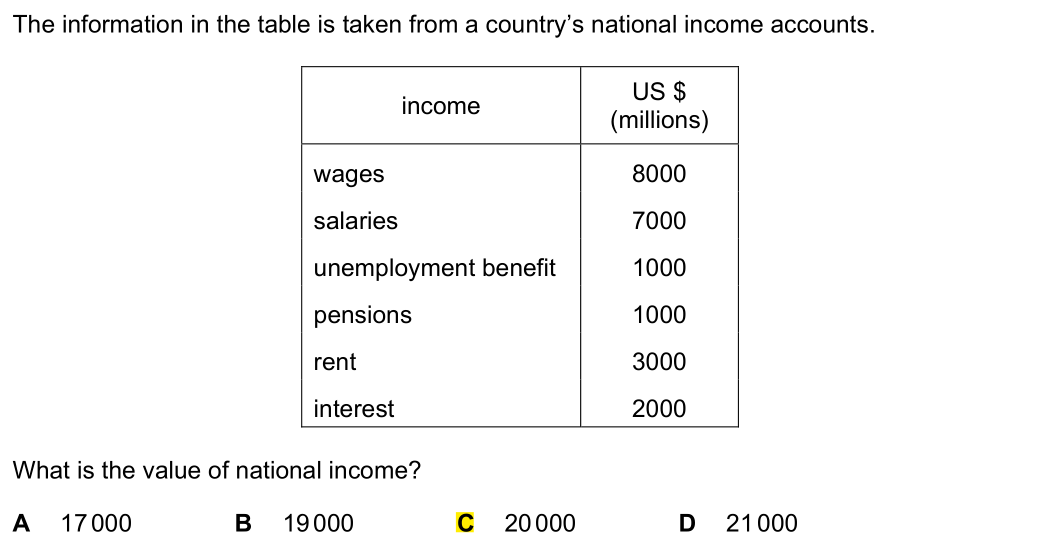

750 + 100 + 170 + X - 120 = 1000X = $100 millionIncome method: GDP = rent + wage + interest + profit用income method算时候要注意unemployment benefit和pensions没有output,因此不能计入。 GDP = 8000 + 7000 + 3000 + 2000 = $20000

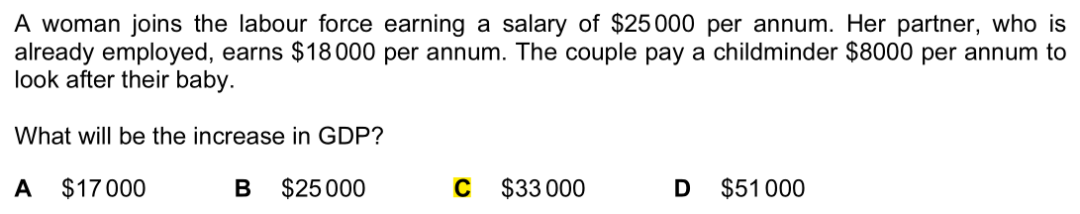

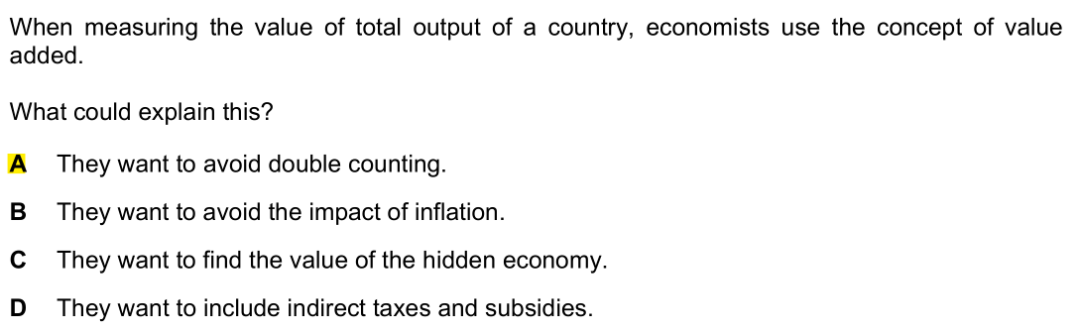

GDP = 8000 + 7000 + 3000 + 2000 = $20000 Increase in GDP = 25000 + 8000 = $33000这里Partner去年就已经工作了,因此赚的钱不属于'increase' in real GDP.Output method: GDP = Sum of value added by all firms in the economy虽然选择题还没考过计算,但是Output method的知识点大家需要掌握。

Increase in GDP = 25000 + 8000 = $33000这里Partner去年就已经工作了,因此赚的钱不属于'increase' in real GDP.Output method: GDP = Sum of value added by all firms in the economy虽然选择题还没考过计算,但是Output method的知识点大家需要掌握。 b. factor cost and market price商品生产出来以后,indirect tax提高价格,subsidy降低价格,因此market price和factor cost并不一样。GDP at market price = GDP at factor cost + indirect tax - subsidy

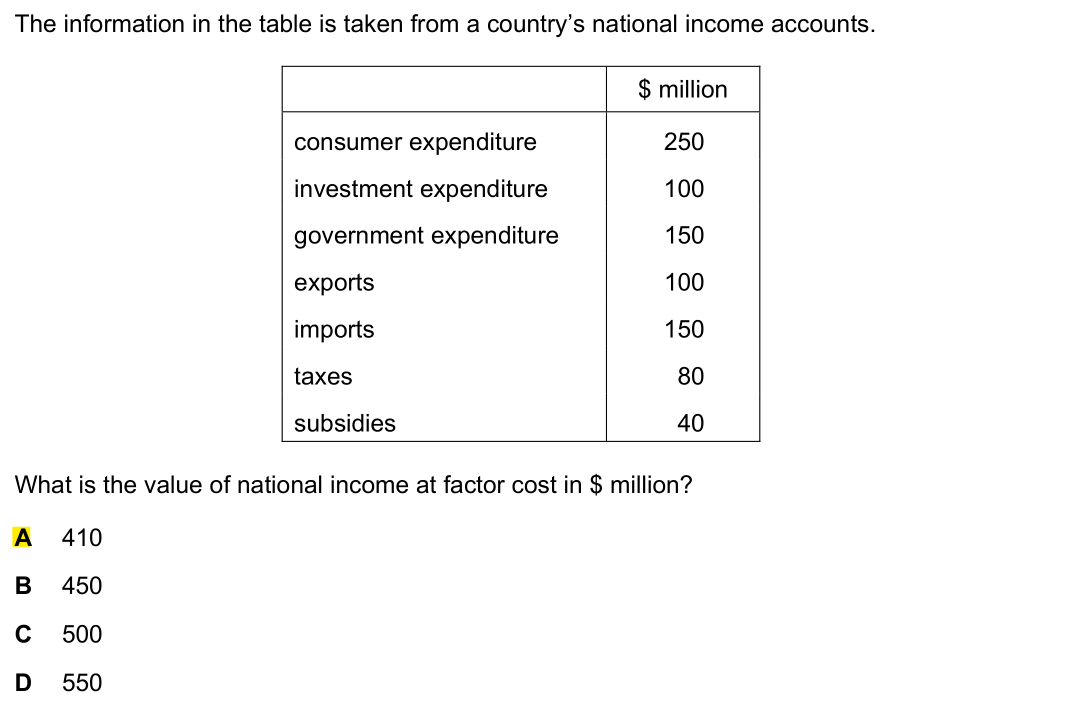

b. factor cost and market price商品生产出来以后,indirect tax提高价格,subsidy降低价格,因此market price和factor cost并不一样。GDP at market price = GDP at factor cost + indirect tax - subsidy 250 + 100 + 150 + 100 - 150 = NI at factor cost + 80 - 40NI at factor cost = $410.c. Gross National Income (GNI)GDP是本国的收入,而GNI是本国人的收入。GDP加上本国人从国外获得的factor income减去外国人从本国获得的factor income等于GNI。GNI = GDP + net factor income from abroad

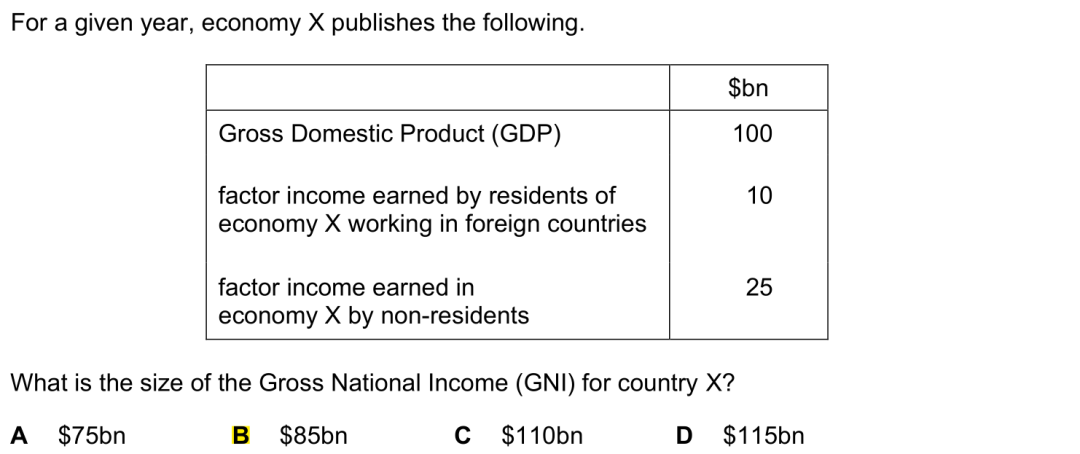

250 + 100 + 150 + 100 - 150 = NI at factor cost + 80 - 40NI at factor cost = $410.c. Gross National Income (GNI)GDP是本国的收入,而GNI是本国人的收入。GDP加上本国人从国外获得的factor income减去外国人从本国获得的factor income等于GNI。GNI = GDP + net factor income from abroad GNI = 100 + 10 - 25 = $85.d. Net National Income (NNI)Capital在使用的过程中会发生折旧.NNI = GNI - depreciation (capital consumption)

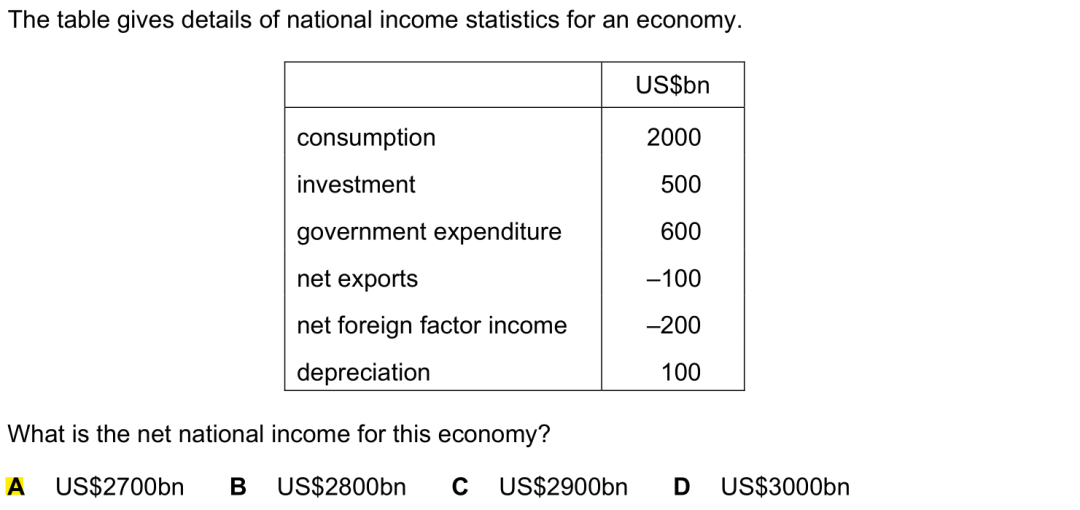

GNI = 100 + 10 - 25 = $85.d. Net National Income (NNI)Capital在使用的过程中会发生折旧.NNI = GNI - depreciation (capital consumption) GNI = 2000 + 500 + 600 - 100 - 200 = $2800.NNI = GNI - 100 = $2700.e. Disposable Personal IncomeDisposable Income 是用来衡量消费者可支配资金的指标,因此Transfer payments也是计入的。Disposable Personal Income = Personal Income - Personal Tax and Nontax Payments

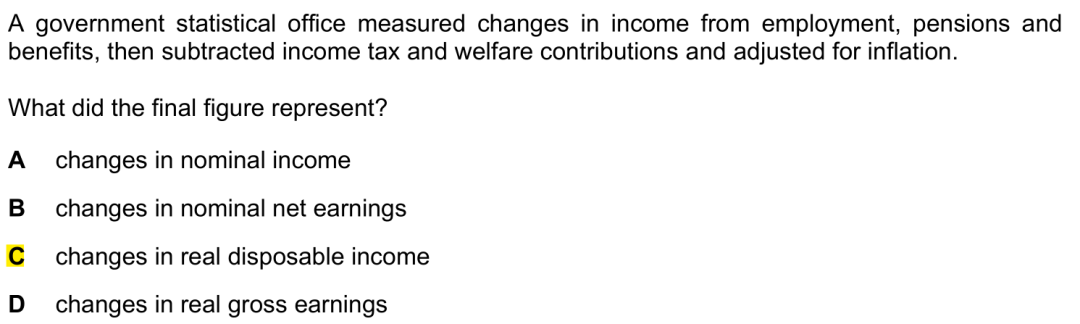

GNI = 2000 + 500 + 600 - 100 - 200 = $2800.NNI = GNI - 100 = $2700.e. Disposable Personal IncomeDisposable Income 是用来衡量消费者可支配资金的指标,因此Transfer payments也是计入的。Disposable Personal Income = Personal Income - Personal Tax and Nontax Payments 虽然这个概念并不在考纲里,但是因为题目出现过,大家最好了解一下。2. Circular flow of incomeAt equilibrium income, injections = leakages.Government expenditure + investment + exports = taxation + savings + imports.

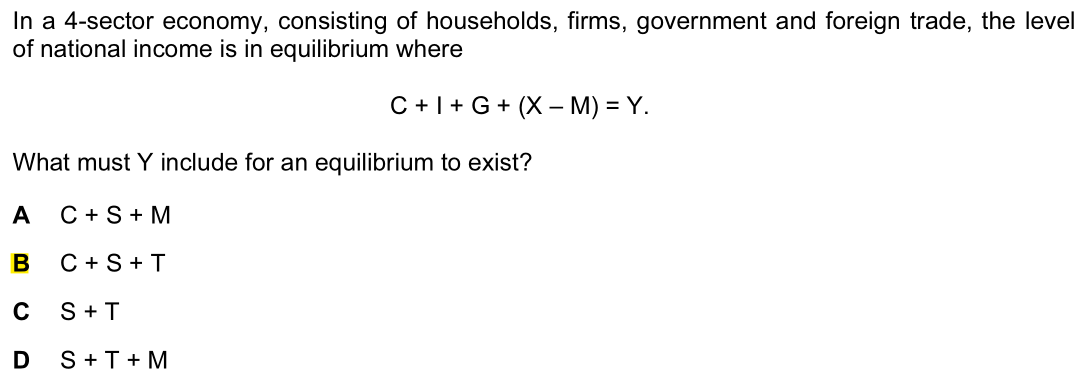

虽然这个概念并不在考纲里,但是因为题目出现过,大家最好了解一下。2. Circular flow of incomeAt equilibrium income, injections = leakages.Government expenditure + investment + exports = taxation + savings + imports. Option D: Injections = 400 + 400 + 200 = $1000; Leakages = 250 + 250 + 500 = $1000.

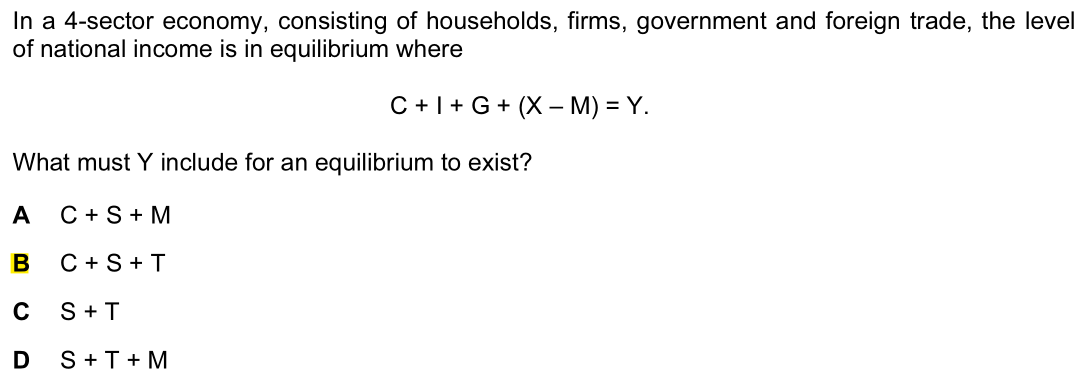

Option D: Injections = 400 + 400 + 200 = $1000; Leakages = 250 + 250 + 500 = $1000. In equilibrium, I + G + X = S + T + MRearrange: I + G + (X - M) = S + T.Therefore, Y must include C + S + T for an equilibrium to exist.3. Unemployment在总人口里,16岁以上的才可以工作,这部分人是working age population.在这部分人里面,只有愿意并有工作能力的人才属于Labour force. 不愿意工作的人并不属于Labour force.Labour force + Not in the labour force = working age populationLabour force分成就业者和失业者两部分。Labour force = unemployment + employment

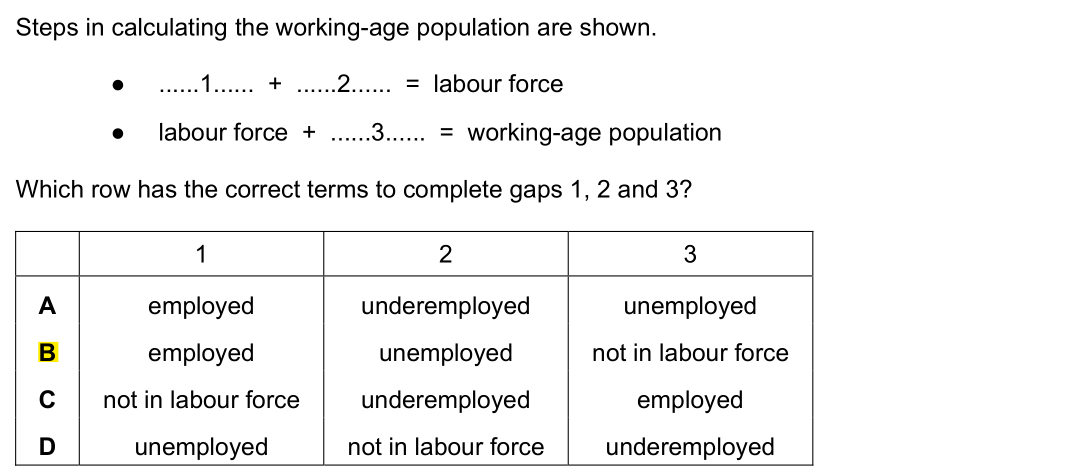

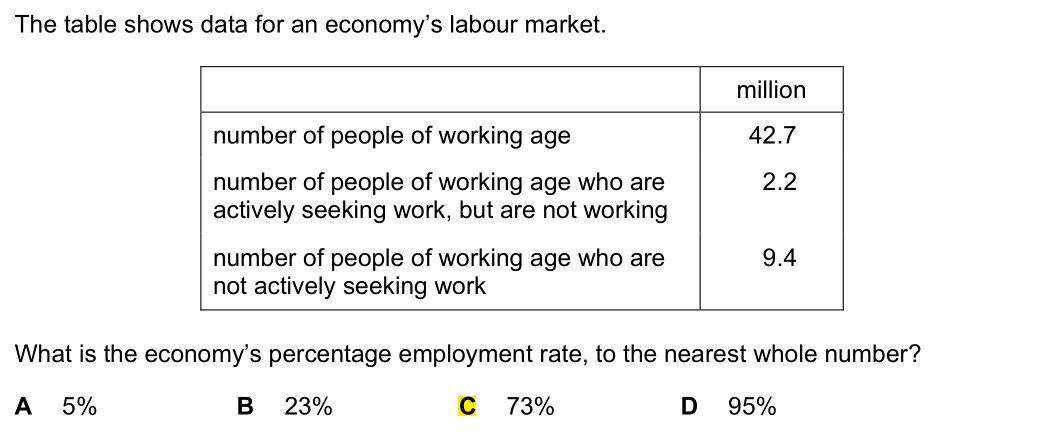

In equilibrium, I + G + X = S + T + MRearrange: I + G + (X - M) = S + T.Therefore, Y must include C + S + T for an equilibrium to exist.3. Unemployment在总人口里,16岁以上的才可以工作,这部分人是working age population.在这部分人里面,只有愿意并有工作能力的人才属于Labour force. 不愿意工作的人并不属于Labour force.Labour force + Not in the labour force = working age populationLabour force分成就业者和失业者两部分。Labour force = unemployment + employment 在16岁及以上的劳动年龄人口中,愿意并有能力工作的人的占比叫做Participation rate.Participation rate = Labour force / working age populationUnemployment rate和Employment rate也是考试的重点。Unemployment rate = unemployed / Labour forceEmployment rate = employed / working age population需要特别注意的是,就业率和失业率的分母不一样,employment rate和unemployment rate加起来不等于1.

在16岁及以上的劳动年龄人口中,愿意并有能力工作的人的占比叫做Participation rate.Participation rate = Labour force / working age populationUnemployment rate和Employment rate也是考试的重点。Unemployment rate = unemployed / Labour forceEmployment rate = employed / working age population需要特别注意的是,就业率和失业率的分母不一样,employment rate和unemployment rate加起来不等于1. Labour force = 5 + 75 = 80.Participation rate = 80/100 = 0.8.Unemployment rate = 5/80 = 0.0625.

Labour force = 5 + 75 = 80.Participation rate = 80/100 = 0.8.Unemployment rate = 5/80 = 0.0625. Working age population = 42.7, not in labour force = 9.4.Labour force = 42.7 - 9.4 = 33.3.Employed = 33.3 - 2.2 = 31.1Employment rate = 31.1/42.7 = 0.728.4. Inflationa. inflation rate

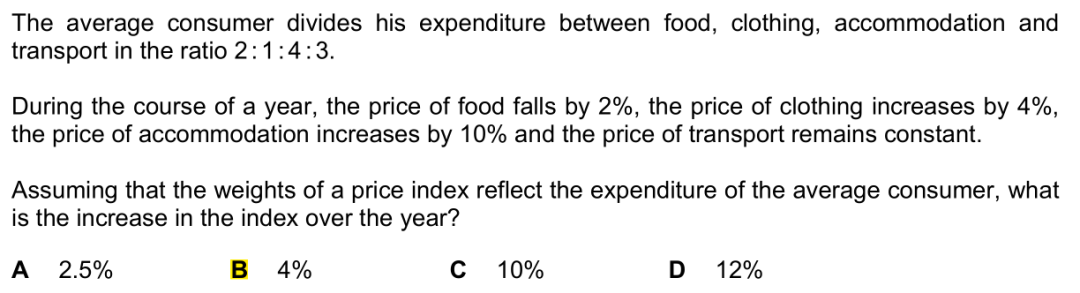

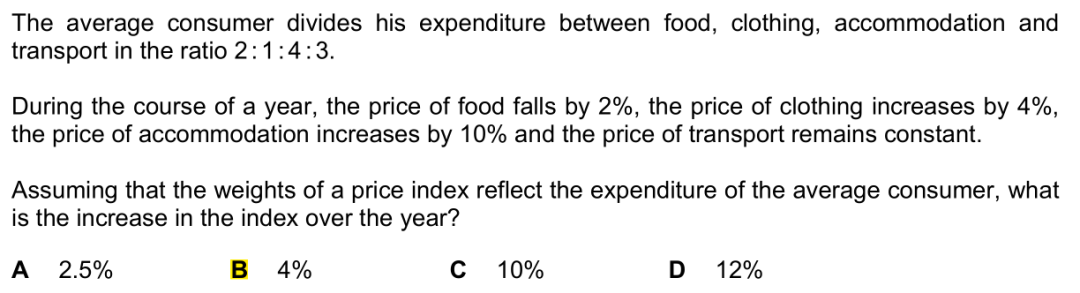

Working age population = 42.7, not in labour force = 9.4.Labour force = 42.7 - 9.4 = 33.3.Employed = 33.3 - 2.2 = 31.1Employment rate = 31.1/42.7 = 0.728.4. Inflationa. inflation rate 这个公式比较复杂,但是理解起来并不难:如果一个商品在CPI的权重是10%,他的价格上涨20%,那他对Inflation的贡献就是10%×20%=2%.把所有商品对CPI的贡献加起来就是inflation rate.

这个公式比较复杂,但是理解起来并不难:如果一个商品在CPI的权重是10%,他的价格上涨20%,那他对Inflation的贡献就是10%×20%=2%.把所有商品对CPI的贡献加起来就是inflation rate. 20%×(-2%) + 10%×4% + 40%×10% = 4%

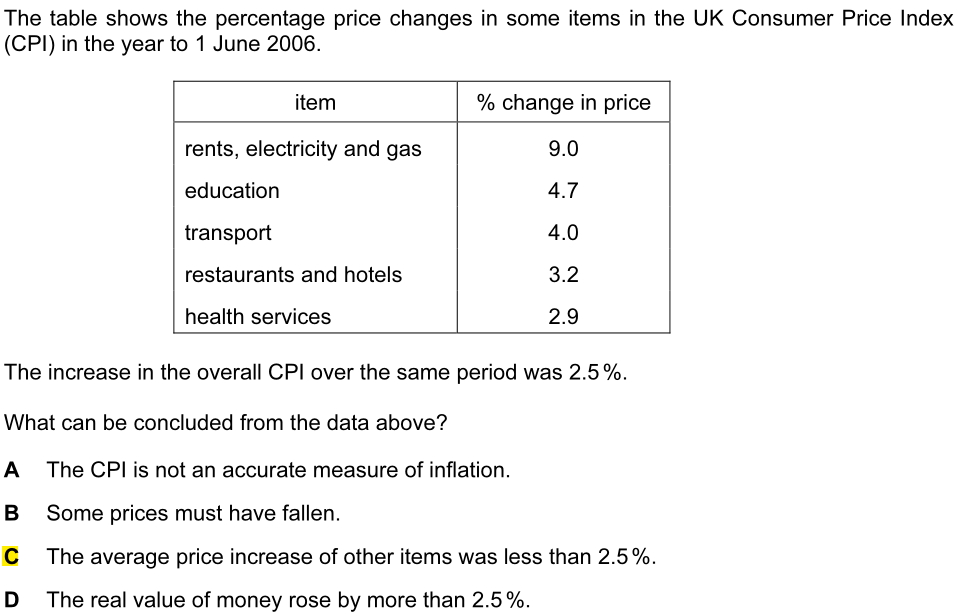

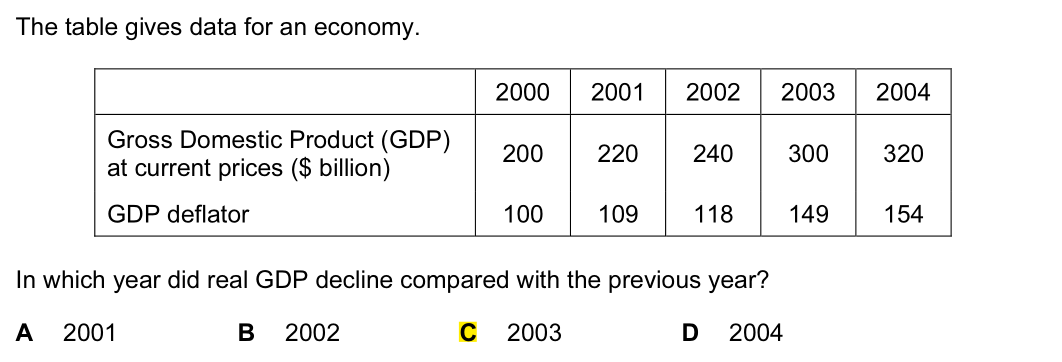

20%×(-2%) + 10%×4% + 40%×10% = 4% 表格里每个商品的价格变化都超过2.5%,而CPI只上涨2.5%,那说明其他所有商品的价格上涨合计小于2.5%。这里很多同学可能会选B,其实是不理解公式导致的。b. Price index假设今年末的Price index是100,明年的inflation rate是3%,那明年末的Price index上升到103.

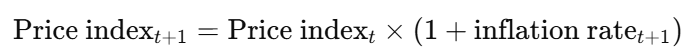

表格里每个商品的价格变化都超过2.5%,而CPI只上涨2.5%,那说明其他所有商品的价格上涨合计小于2.5%。这里很多同学可能会选B,其实是不理解公式导致的。b. Price index假设今年末的Price index是100,明年的inflation rate是3%,那明年末的Price index上升到103.

(1+0.02)^4 = 1.0824.Hence, price level rose by 8.24%.

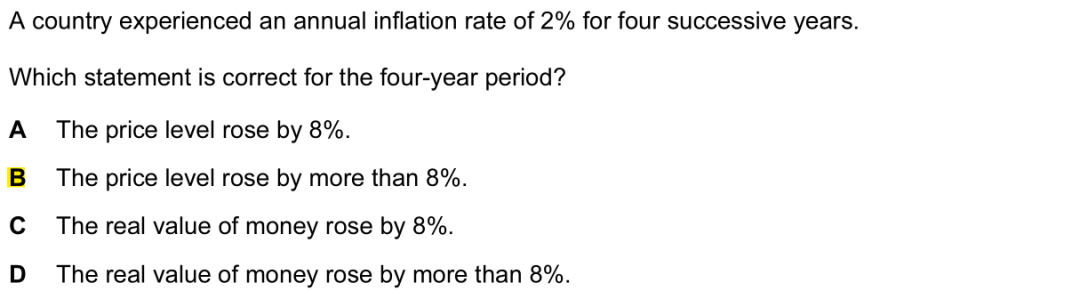

(1+0.02)^4 = 1.0824.Hence, price level rose by 8.24%. (1-0.02)^4 = 0.9223.Hence, price level fell by 7.77%.5. Economic growtha. GDP deflator大家要知道Nominal GDP和Real GDP之间的转换。GDP deflator = (Nominal GDP / Real GDP) × 100

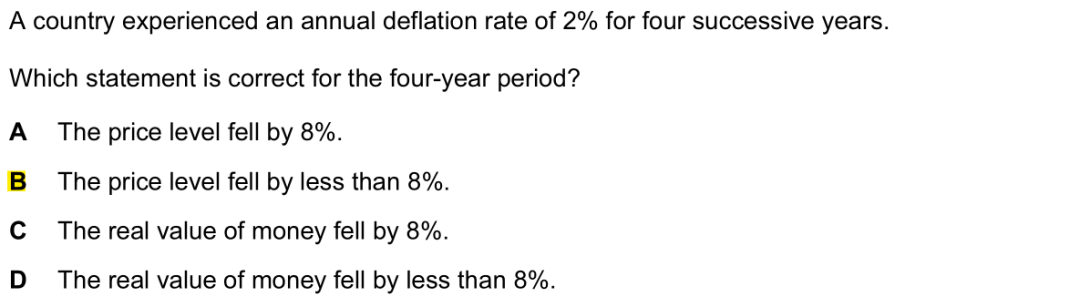

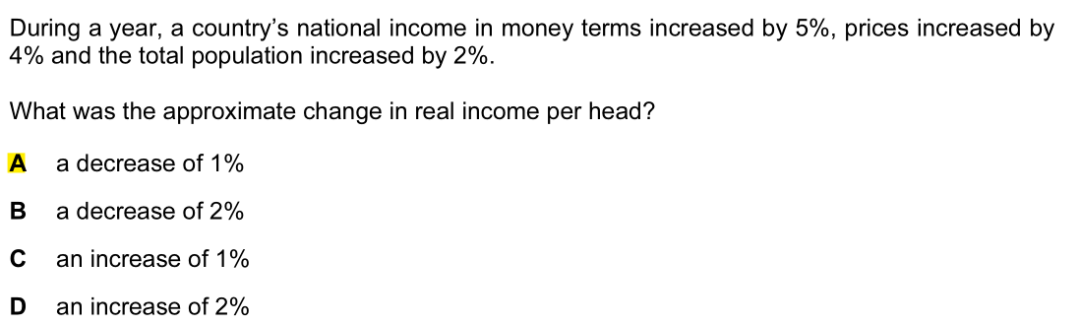

(1-0.02)^4 = 0.9223.Hence, price level fell by 7.77%.5. Economic growtha. GDP deflator大家要知道Nominal GDP和Real GDP之间的转换。GDP deflator = (Nominal GDP / Real GDP) × 100 2000: RGDP = 20000/100 = 200.0.2001: RGDP = 22000/109 = 201.8.2002: RGDP = 24000/118 = 203.42003: RGDP = 30000/149 = 201.3b. Real GDP per capitaReal GDP per capita的增长率是衡量SOL的一个很好的指标。Changes in real GDP per capita = % change in income - % change in population - % change in price level

2000: RGDP = 20000/100 = 200.0.2001: RGDP = 22000/109 = 201.8.2002: RGDP = 24000/118 = 203.42003: RGDP = 30000/149 = 201.3b. Real GDP per capitaReal GDP per capita的增长率是衡量SOL的一个很好的指标。Changes in real GDP per capita = % change in income - % change in population - % change in price level 5% - 4% - 2% = -1%.需要注意的是这个公式在AS考纲里只有算real GDP per capita的变化时才可以使用 (因为只有这里有多个variable).其他要求完全准确的计算题不能使用这个公式。感兴趣的同学也可以看下这篇推送:AS经济 | Percentage changes in a Multivariable Equationc. Net investmentNet investment大于0意味着Producitive capacity增加,LRAS往右shift.Net investment = Gross investment - depreciation.

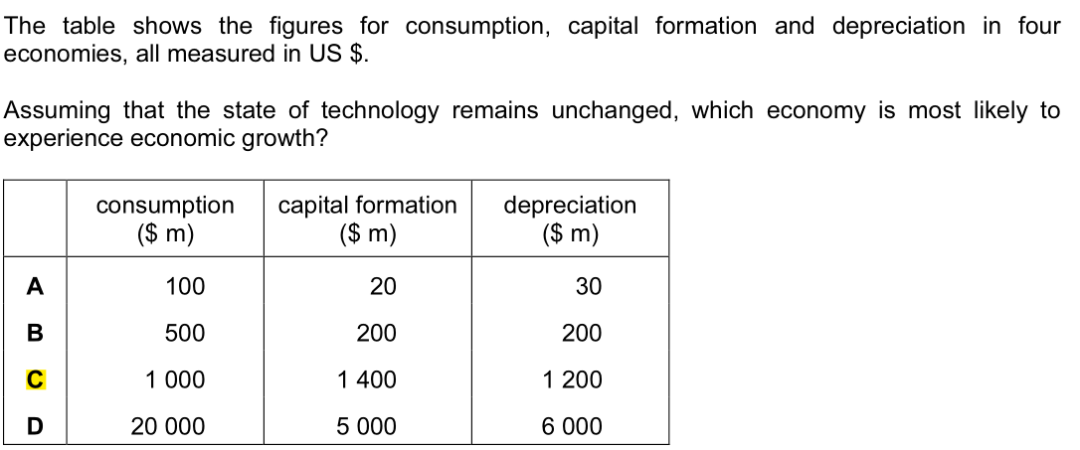

5% - 4% - 2% = -1%.需要注意的是这个公式在AS考纲里只有算real GDP per capita的变化时才可以使用 (因为只有这里有多个variable).其他要求完全准确的计算题不能使用这个公式。感兴趣的同学也可以看下这篇推送:AS经济 | Percentage changes in a Multivariable Equationc. Net investmentNet investment大于0意味着Producitive capacity增加,LRAS往右shift.Net investment = Gross investment - depreciation. 这里只有C选项Capital formation大于depreciation. Consumption的数据没有意义。6. Fiscal policya. Marginal rate of taxation (MRT)MRT是每多赚1块钱要交的税。MRT = change in tax paid/change in income

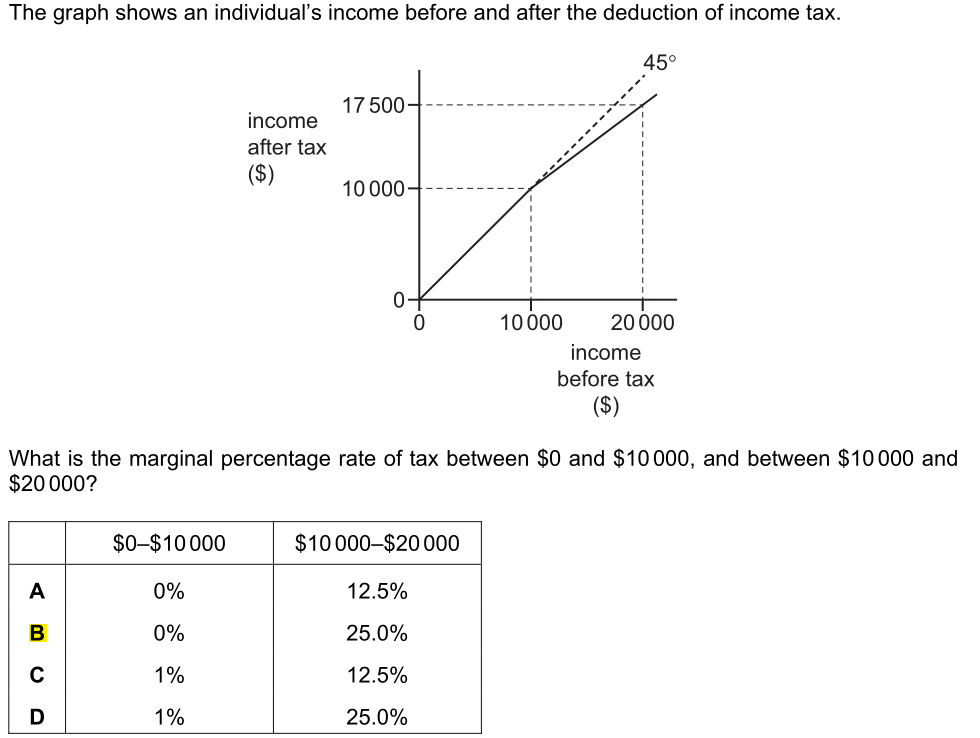

这里只有C选项Capital formation大于depreciation. Consumption的数据没有意义。6. Fiscal policya. Marginal rate of taxation (MRT)MRT是每多赚1块钱要交的税。MRT = change in tax paid/change in income 工资超过10000以后,change in income = $10000, change in tax paid = $2500, MRT = 25%.b. Average rate of taxation (ART)ART是交的税占工资的比例。ART = Taxation/Income.

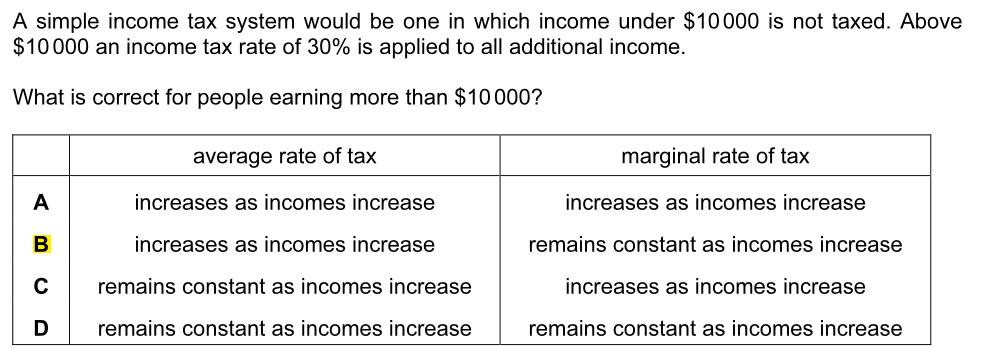

工资超过10000以后,change in income = $10000, change in tax paid = $2500, MRT = 25%.b. Average rate of taxation (ART)ART是交的税占工资的比例。ART = Taxation/Income. If Y < $10,000, average rate of tax (ART) = 0, marginal rate of tax (MRT) = 0.If Y > $10,000, MRT = 0.3.ART = 0.3 * (Y – 10,000) / Y = 0.3 – 3000/Y.Therefore, when Y increases, ART increases.c. Government budget balanceTax revenue < Government expenditure -> Budget deficit这里大家还要知道budget deficit和national debt的关系:如果今年是deficit明年还是deficit,那每一年的debt都是增加的。The budget deficit in yeartwill add to the national debt in yeart+1.

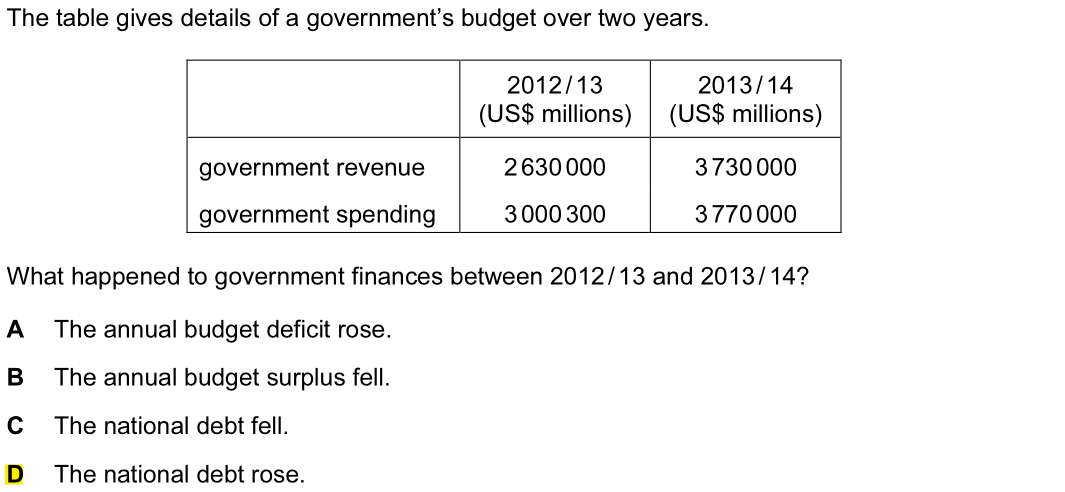

If Y < $10,000, average rate of tax (ART) = 0, marginal rate of tax (MRT) = 0.If Y > $10,000, MRT = 0.3.ART = 0.3 * (Y – 10,000) / Y = 0.3 – 3000/Y.Therefore, when Y increases, ART increases.c. Government budget balanceTax revenue < Government expenditure -> Budget deficit这里大家还要知道budget deficit和national debt的关系:如果今年是deficit明年还是deficit,那每一年的debt都是增加的。The budget deficit in yeartwill add to the national debt in yeart+1. 2012-2013: revenue - spending = -3703002013-2014: revenue - spending = -40000Annual budget deficit falls, national debt increases.7. Comparative advantageFree trade的题都要做两件事:1. 算各自的opportunity cost2. Exchange rate必须在两个国家的OC之间。

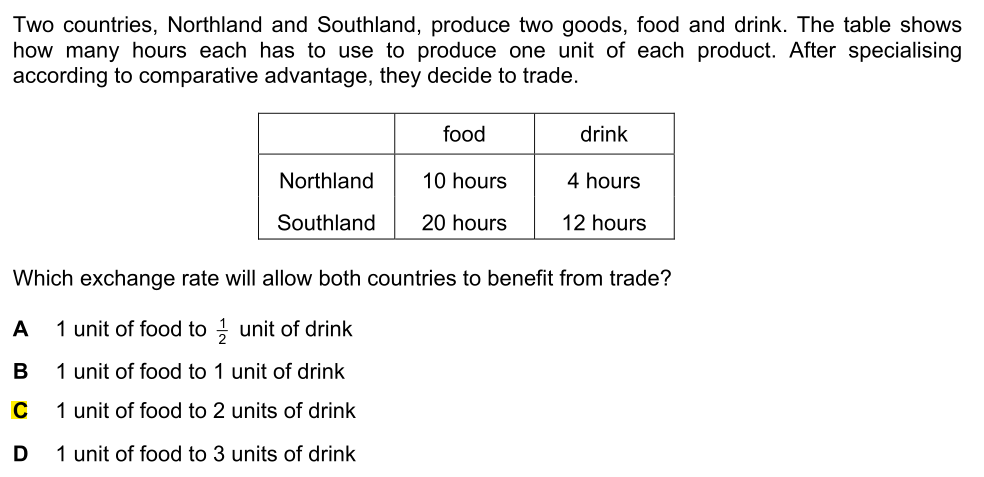

2012-2013: revenue - spending = -3703002013-2014: revenue - spending = -40000Annual budget deficit falls, national debt increases.7. Comparative advantageFree trade的题都要做两件事:1. 算各自的opportunity cost2. Exchange rate必须在两个国家的OC之间。 题目给的是hours,我们先换成60hours下的Output.Northland: 6 food, 15 drinks.Southland: 3 food, 5 drinks.接下去算OC.Northland: 1 food = 2.5 drinks.Southland: 1 food = 1.67 drinks.Exchange rate必须在1 food 等于 1.67到2.5个drinks之间。8. Terms of tradeTerms of trade index = (index of export prices/index of import prices) × 100

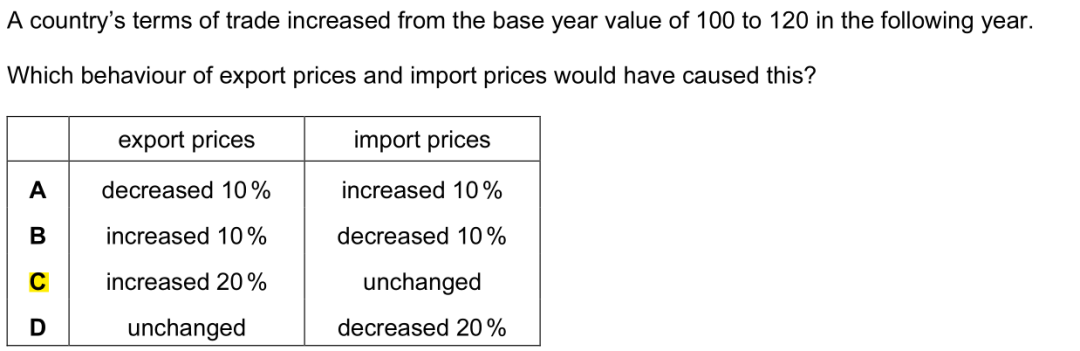

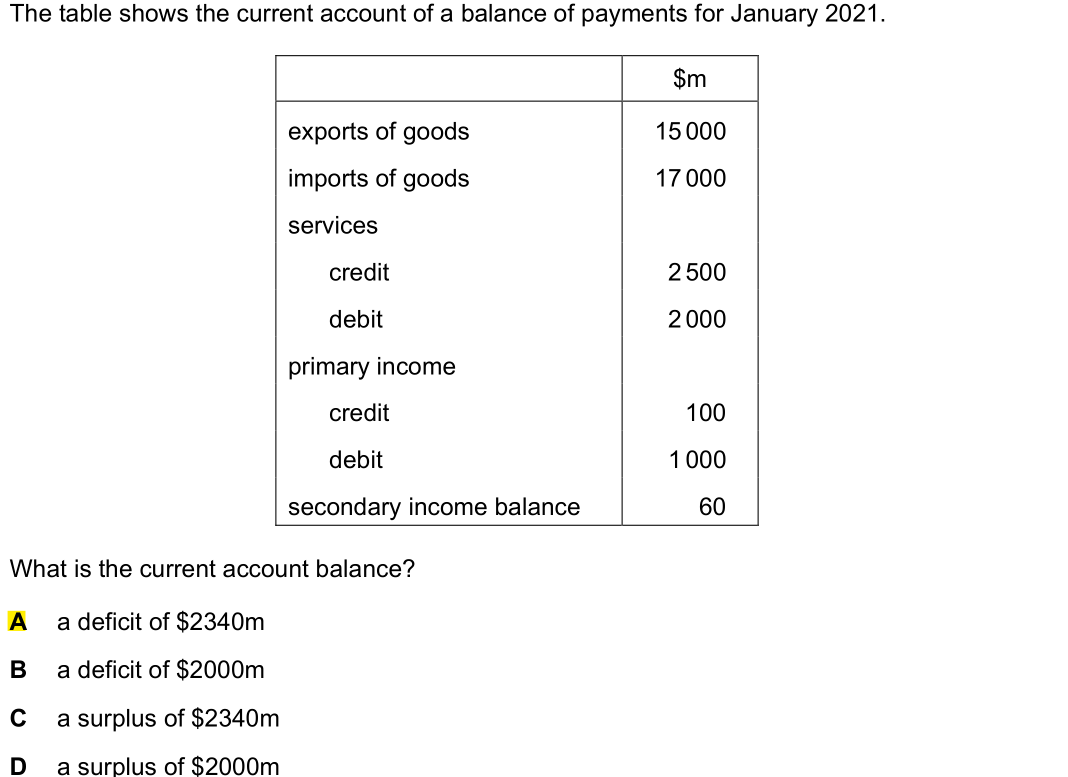

题目给的是hours,我们先换成60hours下的Output.Northland: 6 food, 15 drinks.Southland: 3 food, 5 drinks.接下去算OC.Northland: 1 food = 2.5 drinks.Southland: 1 food = 1.67 drinks.Exchange rate必须在1 food 等于 1.67到2.5个drinks之间。8. Terms of tradeTerms of trade index = (index of export prices/index of import prices) × 100 假设一开始export prices和import prices都是100.B:TOT = 11000/90 = 122C:TOT = 12000/100 = 120D:TOT = 10000/80 = 1259. Current accountCurrent account有4个components.钱流进来是credit, 记为+号; 钱流出去是debit, 记为-号.Current account = trade in goods + trade in services + primary income + secondary income

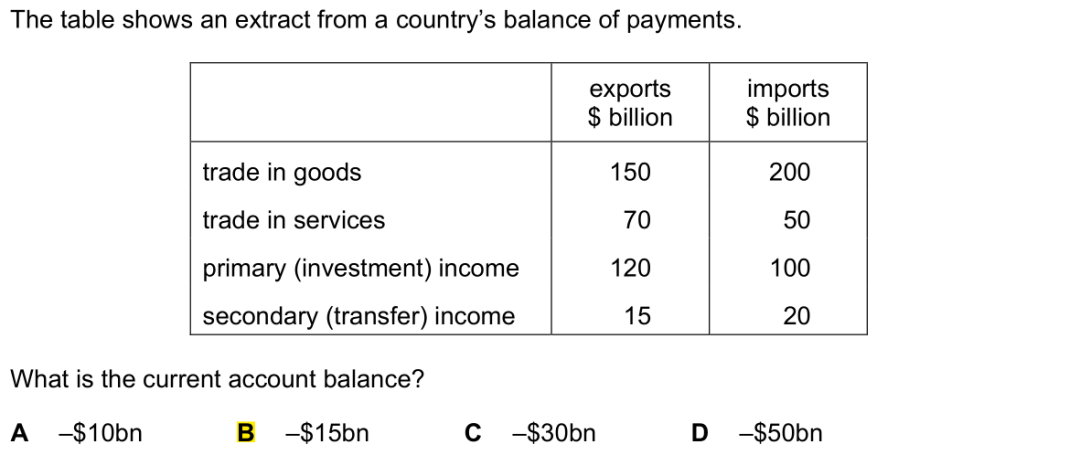

假设一开始export prices和import prices都是100.B:TOT = 11000/90 = 122C:TOT = 12000/100 = 120D:TOT = 10000/80 = 1259. Current accountCurrent account有4个components.钱流进来是credit, 记为+号; 钱流出去是debit, 记为-号.Current account = trade in goods + trade in services + primary income + secondary income 150 + 70 + 120 + 15 - 200 - 50 - 100 - 20 = -$15.

150 + 70 + 120 + 15 - 200 - 50 - 100 - 20 = -$15.

15000 - 17000 + 2500 - 2000 + 100 - 1000 + 60 = -$2340

所有计算题,大家都需要把公式背准确,这样才可以做对题目。祝大家备考顺利!